|

|

Social Security Numbers are not required for employment. By Steven D. Miller I am not a lawyer. I don’t give legal advice. Nothing here is legal advice. Here is information from official sources, so that you can find out for yourself. Make your own conclusions. PROOF THAT SSNs ARE NOT REQUIRED FOR EMPLOYMENT: Appellate court finding in the David Alan Carmichael case http://law.justia.com/cases/federal/appellate-courts/F3/298/1367/643105/ EEOC determination in the Bruce Hanson vs Information Systems Consulting case. Link… Do you have equal protection under the law? Protected by the restrictions on government that is equal to theirs? “GIVING YOUR NUMBER IS VOLUNTARY” except when mandatory. SSA brochure 05-10002 Your Number and Card (link…) warns that "Giving your number is voluntary even when you are asked for the number directly." and gives advice on what to ask when requested for a number.

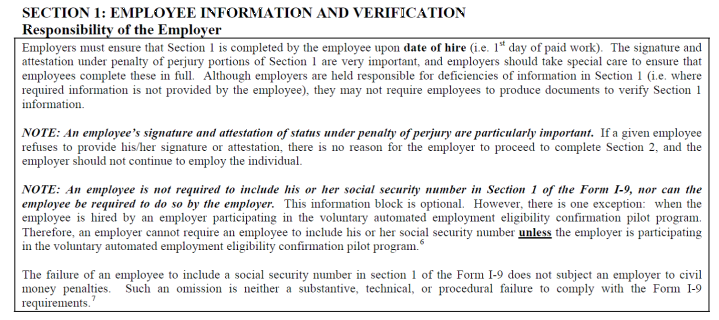

Hand your new employer an SSA brochure 05-10002. Tell your new employer that you are relying in good faith on Social Security Administration advice. After all, SS cards are property of the government, and you are responsible for using it only for it’s legal purposes. Employers are deceived into believing that their forms W-2 and I-9 trump the SSA advice. THE W-4 FORM It is a crime to obtain a signature by deception. The IRS tricks the employers to commit crimes for them. The employer will insist that you must fill out a W-4 form. According to the IRS documents, the W-4 Withholding Exemption form is NOT for Income Tax (tax class 2), it is for Gift and Estate Tax (tax class 5). source… The W-4 form contains a purported Privacy Act Statement. But it doesn’t meet the minimum requirement of the Privacy Act to use the word mandatory. The law requires them to use the word mandatory. The Legislative History of the Privacy Act Public Law 93-579, at page 6963, (source…), explains the intent of Congress in imposing this requirement on federal forms: "Federal requests for personal information shall be accompanied by written or oral notices presented in obvious or highly visible manner, which use the specific terms "mandatory" or "voluntary" in describing the nature of the individual's desired response…. The Committee believes that an agency should be able to communicate to the individual, without intimidation, whether he is required to comply with a request for information…" Yet they continue to act in bad faith. They vehemently refuse to “communicate to the individual, without intimidation, whether he is required to comply with a request for information…" Internal Revenue Code, section 6109(a)(3) requires employers to REQUEST the “identifying number as may be prescribed for securing proper identification of such other person.” But the Withholding Exemption Certificate required by the law is not the W-4 form which is for Gift and Estate Tax. The real Withholding Exemption Certificate for section 6109 does not and cannot exist. The REQUESTed number must be the SSN required by the Internal Revenue Code section 6109(d), (I've added the emphasis): "The SOCIAL SECURITY ACCOUNT NUMBER ISSUED to an individual for purposes of section 205(c)(2)(A) of the Social Security Act shall, except as otherwise be specified under regulations of the Secretary, be used as the identifying number for such individual for purposes of this title." Search as much as you want, but you won't find an issued account number. Yet, this is what your tax law wants. Every April 15th, ,many people swear a perjury oath to their federal god that they have an issued number that does not exist. Also see my essay explaining that Social Security Cards are for welfare applicants (and to aliens after 1972), not for employment. Here… THE I-9 FORM. The employer will also insist that you must fill out an I-9 form that is required by the Migrant Agricultural Workers Protection Act, yet the Homeland Security Employer's Bulletin No. 102 said that the SSN is not mandatory (except for E-Verify).

Their footnotes refer to the IIRIRA. Here is a link to the IIRIRA so you can find out that employer participation in E-Verify is voluntary and cannot be made mandatory. If they want to comply with such things a due process, good faith and a feeble (non) attempt at Privacy Act compliance then they can always revert to the I-9 form. And even the I-9 form presumes that you have a number. Illegal Immigration Reform and Immigrant Responsibility Act IIRIRA § 403(a)(1)(A), quoted below, and § 411 and Federal Register 63 Fed. Reg. 16909. The IIRIRA good faith exception provides that employers cannot be fined if they made a good faith attempt to comply with the verification requirements. They might react harshly against your proof that they only act in bad faith. Neither I-9 nor E-Verify will provide you with a Privacy Act Statement that complies with the Privacy Act, Public Law 93-579. A valid Privacy Act Statement uses the word Mandatory. Discussed later. In the uscis.gov document M- 274 we also find that SSNs are voluntary on the I-9 form.

Also see http://www.uscis.gov/i-9-central/about-form-i-9/e-verify-and-form-i-9 Employers (not employees) have a duty to complete the form I-9. (Employment policy, second page). But Employers were instructed in Bulletin 102, "If a given employee refuses to provide his/her signature or attestation, there is no reason for the employer to proceed to complete Section 2, and the employer should not continue to employ the individual.". As if a number were required, or falsifying a federal document were required. For more information on refusing to sign a perjury oath signature, see my book on Oaths. Do you have a right to contract? If their word should was mandatory, then this instruction conflicts with their own multiple warnings that if the employer knows you are eligible, they cannot discriminate. It is also contrary to the Supreme Court's definition of liberty. And the Constitution says that no state can impair the obligation of contracts. And the Privacy Act, discussed below, was intended to prevent government employers and private businesses from coercing certain data as a condition of employment. It is a crime to obtain a signature by deception. Should you allow them to discriminate because you refused to falsify a federal document, or should you raise religious objections? Do you want to phrase your objections as moral objections or legal objections? Do you want to settle your dispute in small claims court every paycheck? The I-9 form requests your data to comply with The Migrant and Seasonal Agricultural Workers Protection Act (Title 8 Code of Federal Regulations 274a.2 and 29 U.S. Code section 1802). The I-9 form Social Security Number section is voluntary even though the form’s instructions tell you to provide it. (according to Department of Homeland Security Employer’s Bulletin 102, which is no longer posted on their website). Do you already have proof that they are acting in bad-faith for such things as [depending on your situation]: Refusal to provide legitimate Privacy Act statement, refusal to show " clear and unequivocal language" of a tax statute, making an SSN a condition of employment, discrimination against religion, refusal to reasonably accommodate religious beliefs, demanding worship, extortion, attempted genocide, mail fraud, etc. E-verify does not require you to get an SSN if you don’t have one. But it does force you to conform to their perverted definition of citizenship. Do you need to establish a record of citizenship through an Administrative Hearing 5 USC 556? The Immigration law IIRIRA section 403(a)(1) says: (1) PROVISION OF ADDITIONAL INFORMATION.—The person They can say that because the word shall can mean may. More information is in my book on IDs in Appendix B. The I-9 authority comes from Title 8 U.S. Code 1324a, according to its so-called Privacy Act Statement. Yet 8 USC 1324a says it is enforcing the “Migrant and Seasonal Agricultural Worker Protection Act.” It is irrelevant that you do not seek protection under this act. Will you falsify federal forms just because someone wants you to? The implementing regulations in 8 CFR 274a.2(a) say the I-9 form is for Migrant and Seasonal Agricultural Workers under Title 29 USC 1802. Does it apply to others? And furthermore, 8 CFR 274a2(b)(4) Limitations Of Use of Form I-9 states that the form is limited ONLY for enforcement of the Act. Also read: Form I-9 rebuttal http://www.originalintent.org/edu/i-9.php PRIVACY ACT ISSUES Privacy Act section 7: “It shall be unlawful for any Federal, State or local government agency to deny to any individual any right, benefit, or privilege provided by law because of such individual’s refusal to disclose his social security account number.” Except for disclosures required by law. Legislative History of the Privacy Act page 6981 proves that private businesses are also subject to the Acts provisions: Source… “… no person may condition the granting or withholding of any right, privilege, or benefit, or make as a condition of employment the securing by any individual of any information which may be obtained through the exercise of any right secured under the provisions… It reflects the committee’s intention to protect the data subject from coercion by Government agencies or private businesses and organizations who may condition rights, privileges, benefits or considerations otherwise due the person equally with all other citizens upon the obtaining of a personal file or data.” The intent of the legislature's words in the Privacy Act is “… to protect the data subject from coercion by Government agencies or private businesses and organizations who may condition, rights, privileges, benefits or considerations otherwise due the person equally with all other citizens upon the obtaining of a personal file or data.” For more information see my book on Identification Credentials. |

|

|

|

OTHER SOURCES FOR INFORMATION: Arthur Thomas’s employment with Taco Bell never went to court. Source… Leahy v. District of Columbia, 833 F.2d 1046 driver license without SSN, ruling by Judge Ruth Bader Ginsburg. Claire Wolfe's article on SSNs Aaron Bolinger's videos showing the relationship between Social Security Numbers and the prophesied Mark of the Beast. Republic Magazine Issue #6 has an SSN article on page 24 An SSN rescission document package is available from http://www.scribd.com/doc/25162606/Privacy-Act-and-Social-Security-Number-Limitations-5th-Ed Amish do not use Social Security Numbers. To them, taking benefits is proof that you do not trust God (Mark 11:24, Philippians 4:19, etc). Why is it that the Americans who still believe in the motto of the United States -- In God We Trust -- are the Americans who will never use the health care law? Why should they pay to support your greed addiction? Corban (Roman system of forced welfare contributions) nullifies the word of God. Mark 7:11-13. For your duty to pay your tale of bricks to Pharaoh see my book The Citizen Cannot Complain. Is failure to file a tax return a crime? |

|